Floor & Decor Hldgs (NYSE:FND) has been rated by seven analysts in the last three months, with a mix of bullish and bearish views.

The table below provides an overview of current analyst ratings, gives a sense of sentiment changes over the past 30 days, and compares them to previous months for a complete view.

| Bullish | Something Bulgarian | Indifferent | A bit rough | impolite | |

|---|---|---|---|---|---|

| General rating | 1: | 0: | 5:00 | 1: | 0: |

| Last 30 days | 0: | 0: | 1: | 0: | 0: |

| A million ago | 0: | 0: | 0: | 0: | 0: |

| 2 million ago | 0: | 0: | 4: | 1: | 0: |

| 3 months ago | 1: | 0: | 0: | 0: | 0: |

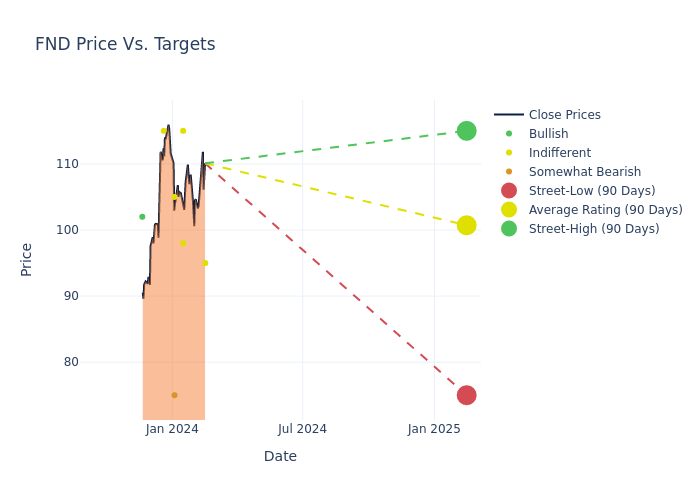

They provide information on analysts' 12-month price targets and indicate an average target of $100.71, a high estimate of $115.00 and a low estimate of $75.00. This upward trend is clear, the current average represents a 20.37% increase from the previous average price target of $83.67.

Commenting on analyst ratings. a closer look

Based on an in-depth analysis of recent analyst activity, a clear picture emerges of how financial professionals perceive Floor & Decor Hldgs. The summary below highlights key analysts, their latest ratings, and adjustments to their ratings and price targets.

| Analyst: | Analysis company | Measures taken | Evaluation: | Current price target | Initial target price |

|---|---|---|---|---|---|

| Joseph Feldman | Telsi Consulting Group | Get up | Market performance | $95.00 | $85.00 |

| Dean Rosenblum | amber | to announce | Market performance | $115.00 | - |

| Peter Keith | Piper Sandler | Get up | neutral | $98.00 | $74.00 |

| Zachary Fadem | Wells Fargo Co. | Get up | Same weight | $105.00 | $85.00 |

| Seth Sigman | Barkley | Get up | Lack of weight | $75.00 | $66.00 |

| W. Andrew Carter | boots | Get up | Save | $115.00 | $95.00 |

| Keith Hughes | Trust papers: | Get up | buy it | $102.00 | $97.00 |

Main results:

- Actions taken Analysts often update their recommendations based on changes in market conditions and company performance. Whether their position is "Hold", "Increase" or "Reduce" reflects their reaction to current events surrounding Floor & Decor Hldgs. This information looks at how analysts view the company's current performance.

- Ratings: Analysts conduct a comprehensive assessment of stocks and rate stocks on a qualitative scale from "Outperform" to "Underperform". These ratings reflect expectations about the relative performance of Floor & Decor Hldgs compared to the broader market.

- Price targets. Analysts analyze price target adjustments and provide estimates for the future value of Floor & Decor Hldgs. By comparing current targets with previous ones, it reports changes in analysts' expectations.

Understanding these analyst estimates and key financial metrics can provide valuable insight into Floor & Decor Hldgs' market position. Stay informed and make decisions with our rankings.

Follow analyst ratings on Floor & Decor Hldgs.

Everything you need to know about flooring and decorations

Floor & Decor Holdings Inc operates as a retail store specializing in the hardwood flooring market. The store offers a wide selection of tile, wood, laminate and natural stone flooring, as well as decor and accessories at affordable prices. It is aimed at a variety of customers including professional installers, commercial businesses, do-it-yourself (DIY) customers and customers purchasing products for professional installation. Geographically, the group is represented in the US and also offers its products through e-commerce sites.

Financial impact of Floor & Decor Hldgs. the analysis

Market capitalization forecast. The company's market capitalization is below the industry average, reflecting its relatively small size compared to similar companies. This positioning may be influenced by factors such as perceived growth potential or scale of operations.

Income growth. Floor & Decor Hldg's sales growth in three months is significant. The company achieved a sales growth rate of about 0.91% as of September 30, 2023. This shows a significant increase in the company's sales. Compared to similar companies in its industry, this company has higher growth rates than the average consumer services provider.

Net profit The financial strength of Floor & Decor Hldgs is reflected in its excellent net profit, which is above the industry average. With an impressive net margin of 5.95%, the company has demonstrated strong profitability and effective cost management.

Return on equity (ROE). Floor & Decor Hldgs' return on equity lags behind the industry average, indicating challenges in maximizing return on equity. With a return on equity of 3.57% , the company may face obstacles to achieving optimal financial results.

Return on equity (ROA). The company's return on equity is excellent and above the industry average. With an impressive return on equity of 1.45%, the company demonstrates efficient utilization of assets.

Debt management With a below average debt to equity ratio of 0.87 , Floor & Decor Hldgs has a prudent financial strategy and demonstrates a balanced approach to debt management.

What are the analyst ratings?

Analyst ratings serve as an important indicator of stock performance and are provided by experts in the banking and financial system. These professionals analyze a company's financial reports, participate in conference calls, and interact with insiders to produce quarterly assessments of individual stocks.

Analysts can improve their estimates by including measures such as growth estimates, revenue and earnings, providing additional guidance to investors. It is important to note that while analysts are stock and industry experts, they are also people and provide their own opinions when providing analytical information.

This article was generated by Benzinga's automatic content engine and reviewed by an editor.